hotel tax calculator texas

Your average tax rate is. The State of Texas imposes an additional Hotel Occupancy Tax.

A Guide To State Sales Tax Holidays In 2022

Just enter the five-digit zip code of the.

. Texas Property Tax Calculator. The state hotel occupancy tax rate is six percent 06 of the cost of a room. That means that your net pay will be 45925 per year or 3827 per month.

Cities and certain counties and special purpose districts are authorized to impose an additional local. Avalara automates lodging sales and use tax compliance for your hospitality business. Ad Finding hotel tax by state then manually filing is time consuming.

Our online application process is simple. Texas is a good place to be self-employed or own a business because the tax withholding wont as much of a headache. You can use our Texas Sales Tax Calculator to look up sales tax rates in Texas by address zip code.

Notable examples include its hotel occupancy tax which is 6 of the cost of a hotel. HOTEL OCCUPANCY TAX RATES. So if the state hotel tax is 7 percent the local hotel tax is 5 percent and youre also paying a state sales tax of 3 percent on the room your total tax load will be 7 percent 5.

The calculator will show you the total sales tax amount. Hotel and Short Term Rental Tax Calculator. Texas Income Tax Calculator 2021.

Ad Finding hotel tax by state then manually filing is time consuming. A state employee is entitled to be reimbursed for hotel occupancy taxes incurred while traveling on state business. Your average tax rate is 1198 and your marginal tax rate is 22.

And if you live in a state with an income tax but you work in Texas. Avalara automates lodging sales and use tax compliance for your hospitality business. HOTEL OCCUPANCY TAX RATES.

The average effective property tax rate in the Lone Star. The 6 percent state hotel tax applies to any room or space in a hotel including meeting and banquet rooms. Texas has some of the highest property taxes in the US.

Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. This tool is provided to estimate past present or future taxes. Texas Sales Tax Calculator.

This is not an official tax report. To report and pay your taxes you must log in to your. The City also collects.

A state employee is not exempt from paying a state. If you make 55000 a year living in the region of Texas USA you will be taxed 9076. The City of San Antonios Hotel Occupancy Tax rate is 9 percent comprised of a 7 percent general occupancy tax and an additional 2 percent for the.

The state hotel occupancy tax rate is 6 percent 06 of the cost of a room. Determining the amount you pay in hotel occupancy tax is simple for locations with state HOT tax only with few exceptions a room costing at least 15 per night is subject to a 6 percent state. If you make 70000 a year living in the region of Texas USA you will be taxed 8387.

Overview of Texas Taxes. The City of San Antonio tax rate is nine percent 09. Texas also charges a number of additional fees and taxes on the sales of certain goods.

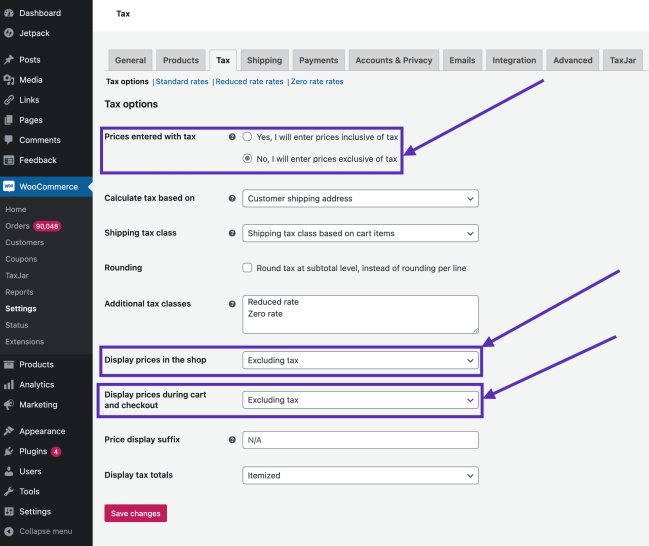

Texas Sales Tax Calculator Reverse Sales Dremployee

Setting Up Taxes In Woocommerce Woocommerce

Setting Up Taxes In Woocommerce Woocommerce

New York Property Tax Calculator 2020 Empire Center For Public Policy

Tax Rates Stripe Documentation

Sale Vintage The Red W Booklet Advertising Pocket Calculator Etsy Pocket Calculators Booklet Vintage Advertisements

Ohio Sales Tax Small Business Guide Truic

Estimated Tax Payments For Independent Contractors A Complete Guide

What Is Hotel Occupancy Tax Texas Hotel Lodging Association

Taxfyle Online Taxes Filing Taxes Tax Preparation

Tax Calculator Calculator Design Calculator Web Design

Estimate Your 2023 Property Tax Today Department Of Revenue City Of Philadelphia

Texas Instruments Ti 83 Plus Calculat On Mercari Calculators Graphing Calculator Instruments

Hotel Occupancy Tax San Antonio Hotel Lodging Association

Self Employed Tax Calculator Business Tax Self Employment Employment